As a national market forms in the U.S., marketing and customer experiences will become crucial for establishing a lasting cannabis brand.

The U.S. cannabis market has a lot to look forward to. Brightfield Group’s latest market forecast shows total domestic cannabis sales will reach $50 billion by 2026, with nearly one-third of those sales expected to come from cannabis markets not yet open today. 2021 has gone by without federal reform, but as it looms on the horizon, we explore what it’ll take to compete in a national cannabis landscape.

National Cannabis Brands Are Coming

Federal cannabis reform will likely provide companies currently operating in consumer packaged goods (CPG), alcohol, tobacco, and Canadian cannabis enough regulatory clarity to confidently enter the U.S. cannabis market. But nationwide competition is already heating up.

Through mergers, acquisitions, and the financial advantage to compete, multi-state-operators are motivated to share their brands across the U.S. Each market that legalizes provides an additional opportunity to form a new stronghold. West Coast brands are taking share of shelf in the Midwest—like Cookies expanding into Michigan—and companies that started in medical markets are expanding into adult-use states—like Trulieve opening dispensaries in California and Arizona.

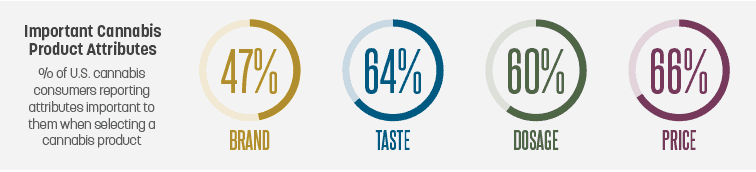

But beyond being on dispensary menus, standing out among consumers will be essential to staying viable as the markets are flooded with new national and local brands.

It’s Time to Move Up the Brand Ladder

Today, many consumers in the most mature U.S. markets view cannabis brands as the same. In fact, a 2021 Brightfield report found 65% of California consumers and 62% of Colorado consumers agree cannabis brands don’t matter to them, and they buy based on what the product has to offer. It gets more difficult for consumers to rationalize buying a specific brand’s product versus another when everything seems the same.

Brands need to continue along the brand ladder by moving beyond product attributes and into emotional and social benefits. Brands like Cookies, Stiiizy, and Native Roots are all described by consumers as brands they trust because these brands have formed emotional connections with their customers.

Gone are the days of selling an indica pre-roll in an unmarked plastic tube. Brands with loyal followings use creative packaging, illustrative cultivar names, and distinct brand markers to create relationships with their customers.

A brand is three things:

- a promise of quality;

- a collection of positive assets and negative liabilities; and

- an emotional perception in the minds of consumers.

The first challenge for a national brand is consistent product quality across markets—whether for flower or edibles, consumers want a consistent experience. Issues with quality or brand perception in one state could affect how consumers view a brand elsewhere.

Even with good products and a good reputation, a successful brand still needs an emotional connection with consumers. The emotional perception someone has of a particular brand depends on how well that brand speaks to their taste, personality, and lifestyle—who they are. But most importantly, how does the product or brand fill their needs? Whether filling the need for concentrates at a reasonable price or the need for pleasantly packaged candies with a low dose of THC, brands should have a clear picture of how their products fit into consumers’ lives.

The U.S. cannabis market has grown to be more than a bunch of small companies operating in a few states. The industry is reaching nationalization as multi-billion dollar companies develop national chains and legalization rapidly expands. Cannabis has reached unprecedented levels of adoption and acceptance, and is now officially a consumer packaged goods industry. And as with any CPG company, good marketing and branding is crucial to success.

Madeline Scanlon is an insights analyst for Brightfield Group.