Marijuana businesses entering New Jersey are facing a sizzling market for retail and industrial cannabis real estate ahead of the launch of recreational sales, forcing them to search aggressively for appropriate sites in limited areas and pay premiums to secure them.

“There certainly is a cannabis markup, as soon as the property owner realizes that it’s going to be a potential cannabis use,” said Rob DiPisa, co-chair of the marijuana law group at Cole Schotz and a partner in the firm’s real estate practice.

Boston-based cannabis multistate operator Ascend Wellness Holdings, which operates in northern New Jersey, found that the area had “arguably some of the most expensive real estate, commercial real estate, industrial real estate, definitely in the eastern part of the country,” Chief Strategy Officer Frank Perullo said.

“As we started looking, we noticed that the prices were high regardless of the condition of the building – it was a market that was hot with or without cannabis.”

Still, out-of-state companies such as Ascend have secured real estate by:

- Hitting the ground and aggressively searching for multiple locations at once.

- Partnering with local property owners.

- Identifying welcoming communities and making early inroads with local officials.

New Jersey is statutorily required to launch adult-use cannabis sales from licensed retailers by February 2022, although the New Jersey Cannabis Regulatory Commission (CRC) reportedly missed a recent deadline to accept adult-use license applications.

“The CRC is doing everything we can to issue licenses in a timely manner. … When the market opens is going to depend largely on how quickly business owners can get operational,” CRC communications director Toni-Anne Blake wrote in a statement to MJBizDaily.

Factors in hot New Jersey market

“Beyond the hot market,” said Ascend’s Perullo, “you have all of those regulatory and general market conditions for cannabis (property) users that really make the selection extremely difficult.”

He cited conditions such as mandated buffer zones between marijuana businesses and schools and parks as well as landlords whose commercial loans might prevent them from accepting cannabis clients.

In light of risks to landlords surrounding financing and insurance, lawyer DiPisa said some cannabis tenants, particularly large multistate operators, are offering hefty advance rent payments and more.

“In the event that a landlord’s bank won’t approve the proposed use, the larger MSOs will walk in and they’ll say, ‘We’ll hold the note, and we’ll become your lender.’”

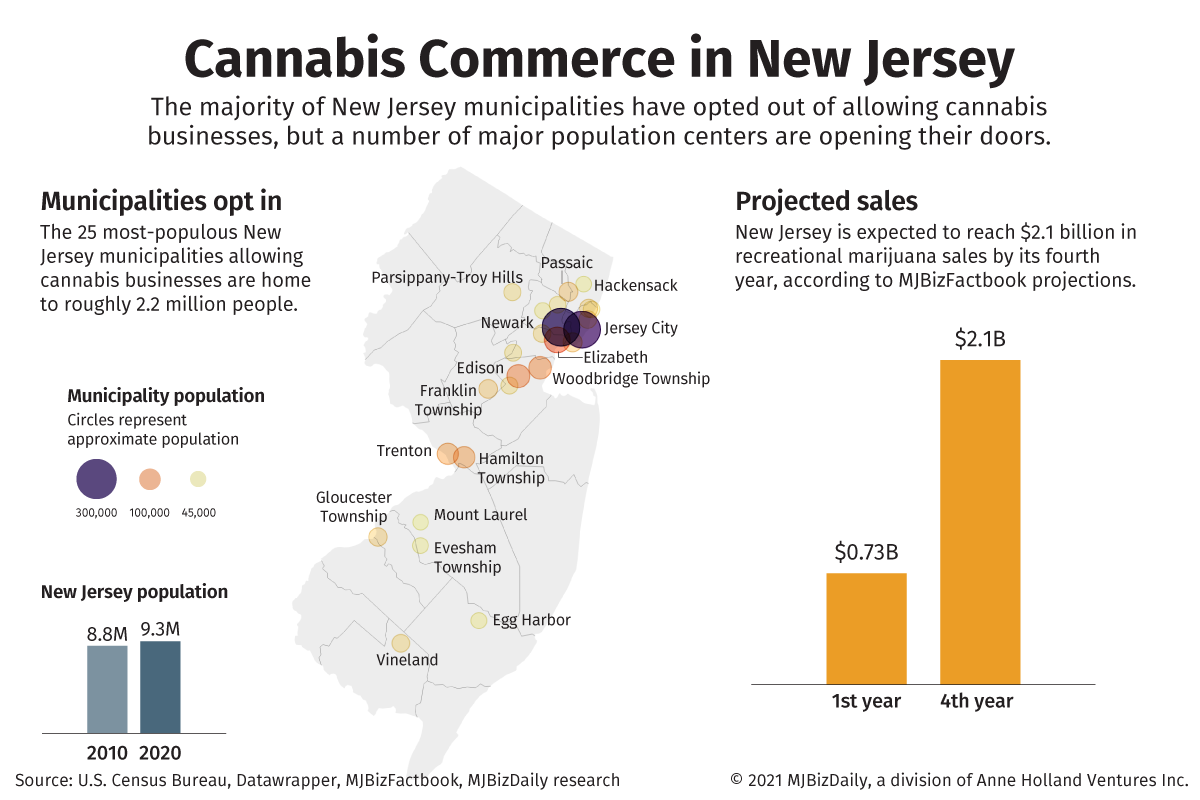

DiPisa identified another factor heating up the market: Roughly 70% of New Jersey municipalities decided by an August deadline not to allow cannabis businesses, although they can reverse that decision at any time.

Plus, DiPisa added, certain opt-in municipalities have zoned specific areas for cannabis retail.

“As soon as the municipal ordinance came out zoning a particular property for, for example, retail use,” he said, “all of a sudden, the owner of that property received a significant amount of offers to purchase and/or lease that property” from both cannabis applicants and would-be landlords.

Competitive markets, big premiums

DiPisa, who works mostly in northern New Jersey, sees lots of interest in cannabis retail real estate in the “Gold Coast” along the Hudson River across from Manhattan – particularly in Jersey City, Hoboken and Fort Lee.

Other hot markets for marijuana businesses include Newark, East Orange and Flemington, according to commercial real estate broker Colby Piper, a director at Ripco Real Estate who specializes in cannabis.

All are densely populated urban markets with opportunities for social equity operators, he said.

“Retail is going to be very, very competitive,” said Piper, adding that New Jersey cannabis microbusinesses will face high competition.

“But there will be more licenses for them to have. … It doesn’t really matter about prime locations, it’s more about being able to get your license and sell cannabis,” he continued.

“Because cannabis is a destination. … Everyone doesn’t need to see the cannabis store, they just need to know where it is.”

No matter what kind of business, Piper said, cannabis companies are willing to pay extra for real estate.

Piper believes premiums of 10%-20% are enough, particularly if the landlord must pay more for refinancing to host a cannabis business.

But some landlords see opportunities to charge even more, he said, seeking premiums of 30%, 40% or even 50% more than market value.

“What I do is, I educate them on the (cannabis) business,” said Piper, adding that educated landlords usually back down to a more appropriate premium.

Real estate success

Colorado-based MSO Terrapin Care Station is moving into New Jersey with a pending application for a medical dispensary in Hoboken that the company hopes to convert to dual use while working to develop a cultivation facility, said Nico Pento, vice president of external affairs.

Pento said Terrapin secured its Hoboken location, near the PATH train to Manhattan, in 2019 through a local partner who owns the property.

For cultivation and processing, that Hoboken partner helped Terrapin scout a southern New Jersey location near the Pennsylvania border.

“He helped us to identify communities that would likely be amenable to having cannabis cultivation,” Pento said.

Terrapin developed a short list by analyzing available properties, local political considerations and access to major roadways for distribution, then developed relationships with local officials.

“We only like to go where we’re wanted,” Pento said. “We don’t want to force ourselves in anywhere.”

MSO Ascend secured its first New Jersey real estate when it acquired Greenleaf Compassion Center in North Jersey in 2020, a deal that included a cultivation facility in Franklin and a dispensary in Montclair as well as the ability to open two more dispensaries.

This year, Ascend opened its second dispensary in Rochelle Park, which Perullo described as “one of the hardest sites to get under control that we’ve ever had.”

For its third dispensary, which is currently under construction in Fort Lee, Ascend secured the former site of a Staples store after convincing the landlord not to renew the retailer’s lease.

Perullo said Ascend was happy with its acquired Franklin cultivation site, “but it wasn’t necessarily going to be able to meet those long-term needs.”

Looking for a new site wasn’t easy, though, especially in the face of competition from other operators in search of production space.

“You’re looking for a 20-year-old or less industrial building with 10,000 to 20,000 amps of power,” Perullo said. “It just doesn’t really exist – there’s very few.”

Ascend ended up keeping its Franklin site and negotiating with the landlord to “start to empty the building out” and retrofit it to allow for more canopy space, Perullo said.

The company is acquiring a building next door to build a production campus.

Tips for New Jersey newcomers

For cannabis companies seeking New Jersey real estate, Perullo recommends being aggressive, partnering with local brokers and door-knocking at businesses in your desired areas to see if they might be leaving soon.

Pursuing just one location might not be enough.

“For us at (Ascend), if we need one site, we look for three,” Perullo said. “If we need two (sites), we look for six or seven.”

For smaller, independent companies such as mom-and-pop retail applicants, DiPisa said it might be especially challenging to know “when they should pull the trigger on locking up real estate,” since they might not have the cash flow to carry the property before they get their license.

He said some cannabis tenants structure deals so they pay the landlord’s monthly carrying costs, or more, while they wait to get licensed and execute on the lease.

Terrapin’s Pento stressed that out-of-state companies can’t just rely on online listings for their search.

“We’ve come a long way in technology these days, and there’s a lot you can do remotely,” he said.

“But in terms of finding the right real estate and the right community, it really comes down to shaking hands and kissing babies.”