The nice thing about a rapidly-growing industry is the proliferation of new data and insights. We scoured the internet to find the most important and relevant marijuana statistics for North America for 2021.

In this report, you’ll see marijuana consumption stats, the national sentiment around weed acceptance, cannabis market growth, employment trends, and legal facts.

Let’s dive into the findings.

Key findings:

- 12% of Americans are active marijuana users.

- Nationwide cannabis sales increased 67% in 2020.

- Support for legal marijuana is at an all-time high of 68%.

- The U.S. cannabis industry is worth $61 billion.

- Cannabis capital raises declined 67% in 2020.

- Senior-level salaries increased in 2020.

1. Marijuana usage statistics

12% of Americans identified as “current users”

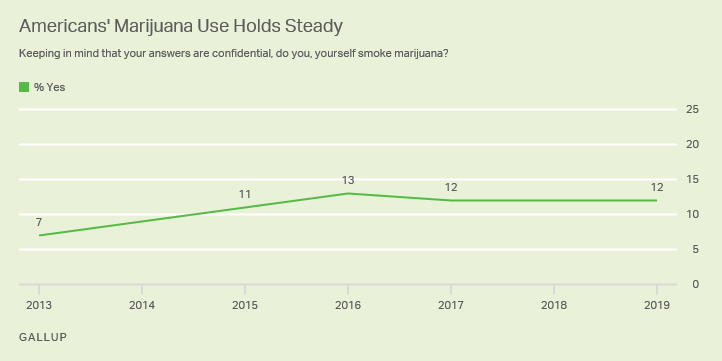

The most recent Gallup poll (from 2019), shows that 12% of Americans are active marijuana users, which is down slightly (from 13% in 2016).

From 2013 to 2016, the number of people who use marijuana nearly doubled. Since then, the rate of use has stayed relatively flat.

22% of Americans aged 18 – 25 used marijuana in the past month

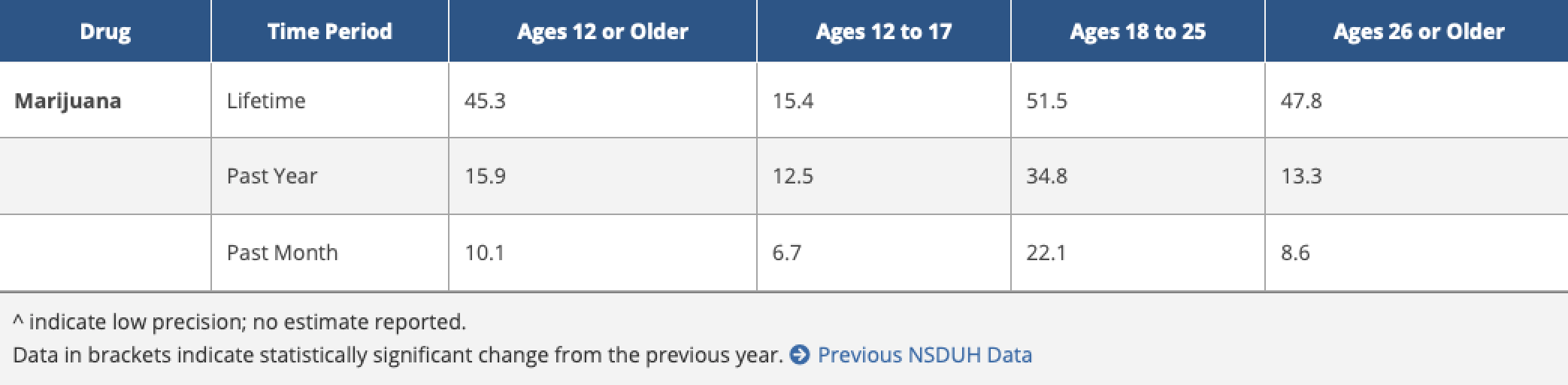

The National Institute of Drug Abuse shows lower numbers compared to Gallup for their most recent survey (2018).

That survey has 8.6% of individuals over 26 years of age identifying as having used marijuana in the past month (which correlates to the Gallup criteria for being a current user). This number is up from 7.9% in their 2017 study.

Meanwhile, 22.1% of 18 – 25-year-olds say they’ve used marijuana in the past month. Half of all people over 18 have used marijuana in their lifetime.

Worldwide, the United Nations estimates that 192 million people used marijuana in 2018.

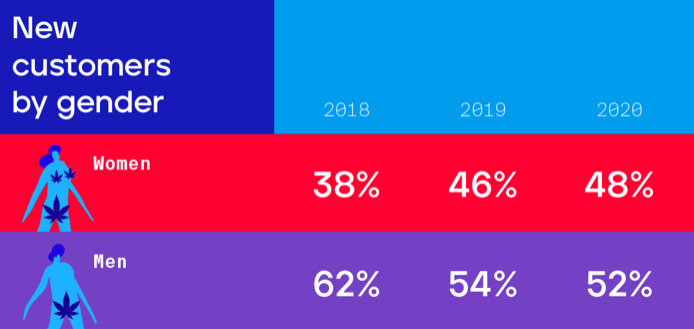

Cannabis consumers diversified (though gender is nearing 50/50)

The cannabis consumer continues to diversify.

The 2020 report from Eaze, a cannabis delivery service in the San Francisco Bay Area, shows the divide in gender disappearing, especially in the boomer age group.

Regarding age, Eaze’s 2019 report showed consumers age 50+ increasing by 105%. They also purchased 67% more topicals than in 2018.

2020 sales by generation from dispensaries using Flowhub shows the generational breakdown of customers as:

2020 Cannabis Sales by Generation

Medical

- Gen Z17%

- Millennials42%

- Gen X23%

- Boomers17%

- Silent Gen1%

Recreational

- Gen Z17%

- Millennials48%

- Gen X21%

- Boomers13%

- Silent Gen1%

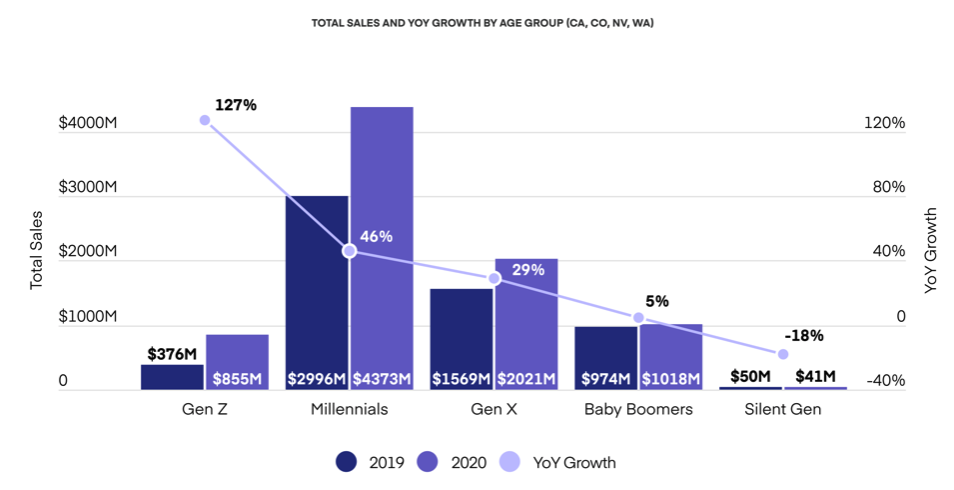

Similarly, cannabis data firm, Headset, found that from 2019 to 2020, Generation Z had 127% sales growth, compared to just 5% for boomers.

This could be due to Gen Z aging into the market every day, but the pandemic also played a role in older generations and their willingness to go out and shop (or use ecommerce).

Nationwide sales increased 67% in 2020

Analysts attribute this massive increase both to changing public perception, but also to the pandemic. More home-bound than ever, and with ongoing fear of shutdowns, people stocked up on cannabis to the tune of nearly $18 billion.

Flowhub data from the State of the Cannabis Industry 2020 report shows the percent change in total sales from 2019 to 2020.

Even during the summer of 2020, when most states were shut down, dispensaries saw increased average order size and thus, increased revenue, even as people shopped less frequently.

Delivery and online ordering reigned supreme

Online ordering, curbside pickup, and delivery were big trends in 2020 that helped consumers get their products quickly and safely.

According to Eaze, in the 30 days following the March 13 declaration of a national emergency, new delivery customer sign-ups jumped by nearly 60%.

Similarly, the State of the Cannabis Industry found that stores with order ahead enabled sold 22% more on average compared to stores without order ahead. Not surprisingly, tech companies in cannabis ecommerce, like Dutchie, dramatically increased their market share in 2020.

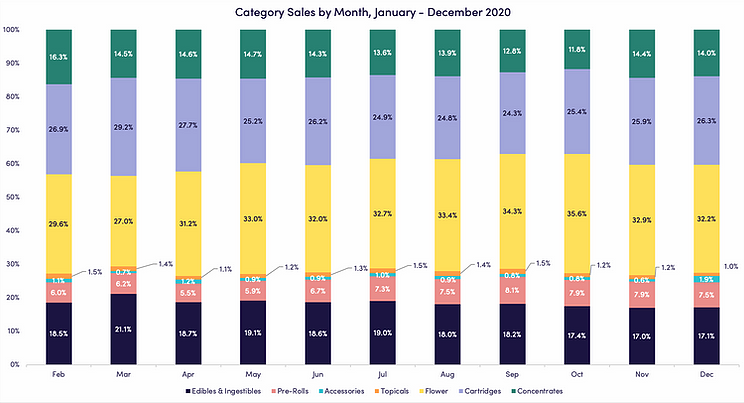

Cannabis product type preferences changed

As consumers change, so do their THC preferences.

In 2019, Eaze saw vape sales decrease by 15% after “vape gate.” Those consumers turned toward edibles (up 24% in Oct. 2019).

2020 followed suit, with edibles being the most popular product category, accounting for 22% of all sales for Eaze.

Speculation was that because COVID-19 is a respiratory illness, consumers would shift away from inhalables.

Leaflink, a cannabis industry wholesale marketplace, found that at the start of the COVID-19 pandemic, inhalables remained popular. And that trend continued throughout 2020, despite flower shortages in some key states like California and Colorado.

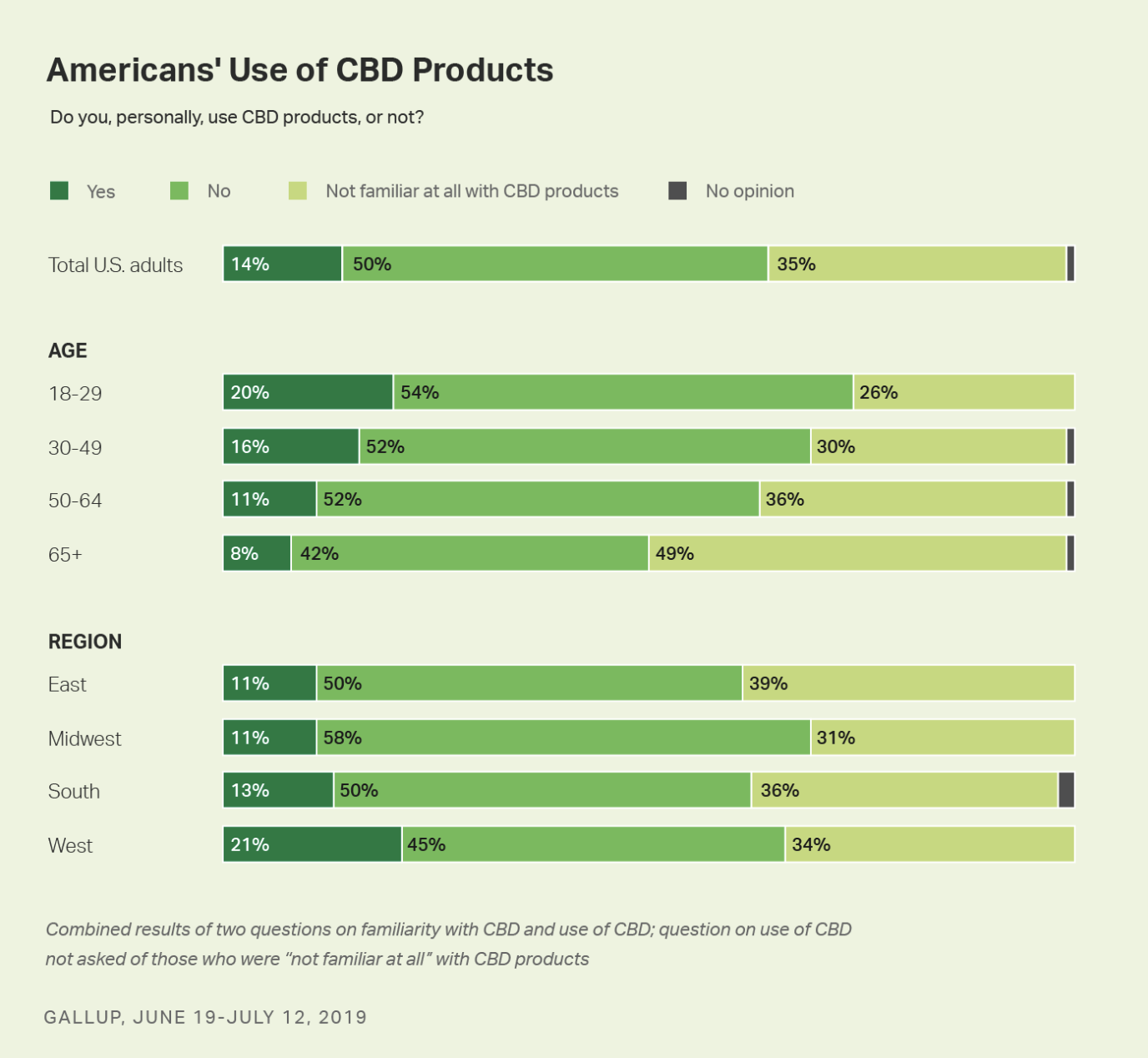

14% of Americans used CBD products

CBD is a broad category, and has hit mainstream since becoming federally legal in 2018. While marijuana users and CBD users may be different, it’s important to note usage in this group.

According to Gallup, 14% of all U.S. adults use CBD. This jumps to 20% for those ages 18-29.

Perhaps most interesting is the question of familiarity with CBD products: 49% of those age 65+ are unfamiliar with CBD (compared to just 26% of those age 18-29).

The same study found the most common reasons for using CBD include:

- Pain – 40%

- Anxiety – 20%

- Sleep/Insomnia – 11%

- Arthritis – 8%

- Migraines/Headaches – 5%

2. Acceptance of recreational marijuana

Recreational use is legal in 12 U.S. states

As of January 2021, 12 states have legalized the use of recreational cannabis (in addition to medical marijuana) for individuals over age 21: California, Alaska, Oregon, Washington, Maine, Colorado, Nevada, Vermont, Michigan, Massachusetts, Illinois, and Arizona (plus the District of Columbia).

During the 2020 election, Arizona voted to legalize recreational and started sales in late January. Montana and New Jersey also voted to legalize adult-use. South Dakota voted in favor of medical and recreational simultaneously.

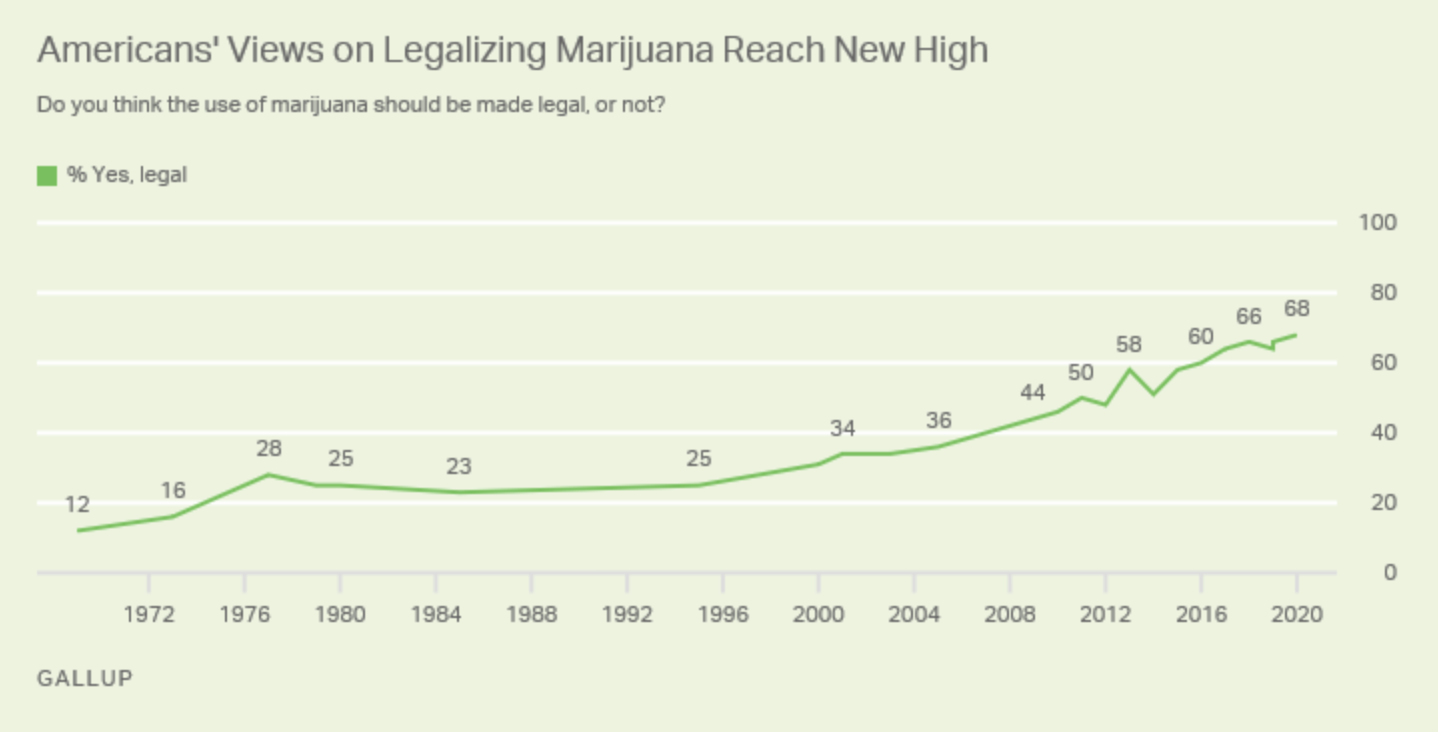

Two in three Americans support marijuana legalization

According to a Gallup poll, support for legal marijuana is at an all-time high of 68%. Among 18 to 29-year-olds, that support rises to 79%. In 2018, 66% of all Americans supported legalization.

The first time Gallup took the same poll, in 1969, just 12% of American held the same view.

Currently 48% of Republicans and 83% of Democrats are in favor, showing that recreational legalization at the state level in Republican-dominated states still has a way to go. Between 2018 and 2020, Republican support for legalization decreased (from 53% to 48%), while Democrat support jumped (from 71% to 83%).

That said, several traditionally red states have entered the cannabis market with gusto, including Oklahoma.

3. Growth of the medical marijuana market

Medical cannabis is now legal in 34 US states

Cannabis is also now legal in 34 states for medical purposes: Hawaii, Montana, Rhode Island, New Mexico, New Jersey, Delaware, Connecticut, Illinois, New Hampshire, Maryland, Minnesota, New York, Pennsylvania, Ohio, Florida, North Dakota, Arkansas, Louisiana, West Virginia, Oklahoma, Utah, Missouri. And the 12 states that also have recreational marijuana: California, Alaska, Oregon, Washington, Maine, Colorado, Nevada, Vermont, Michigan, Massachusetts, Illinois, Arizona, and the District of Columbia.

Election day 2020 was big for medical marijuana: Mississippi voted to legalize medical, and South Dakota passed legislation for both med and rec.

Time from medical to recreational to first sale shortened

As the industry matures, we’re seeing significantly less time from when medical weed is first legalized, to the first recreational sale.

According to Marijuana Business Daily, California took 7,308 days from med to rec to first sale. Massachusetts, just 1,463 days.

4. Cannabis market opportunity

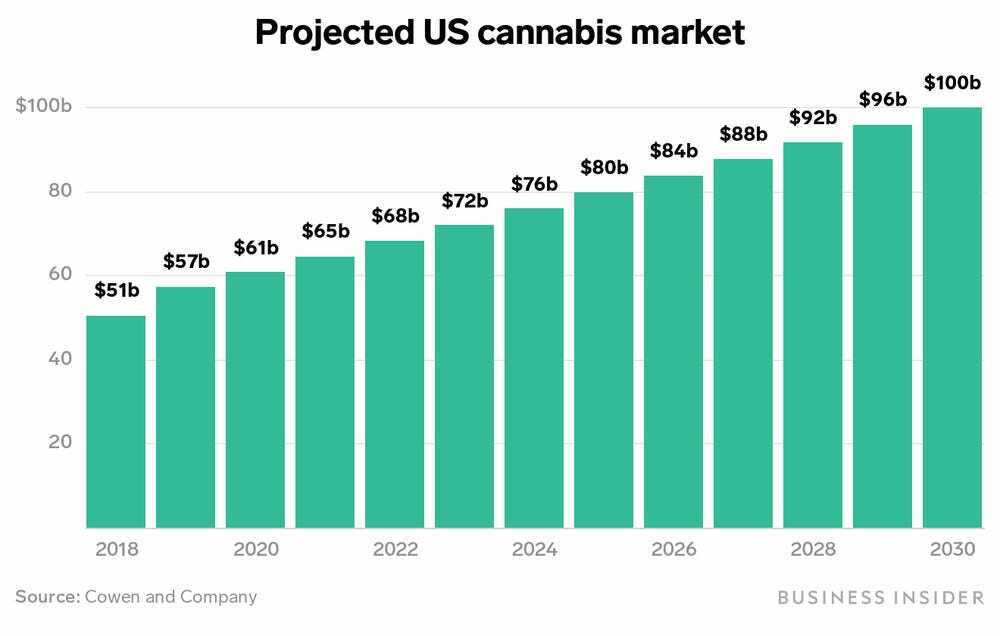

The U.S. cannabis industry is worth $61 billion

Every year, analysts predict what the cannabis industry is worth. And every year that number exceeds expectations.

The U.S. cannabis industry is now projected to be worth $100 billion USD by 2030.

For reference, in 2019, Wall Street’s top cannabis analyst, Cowen Vivien Azer, predicted it’d be $80 billion by 2030.

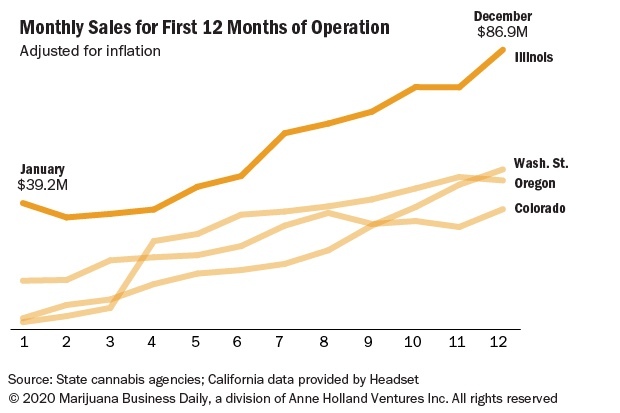

Illinois: first year of MMJ sales topped $1 billion

Recreational sales started in Illinois in January 2020, and total sales numbers (including both med and rec) topped $1 billion dollars by December.

That’s over 14.5 million products sold — with 25% going to out-of-state residents.

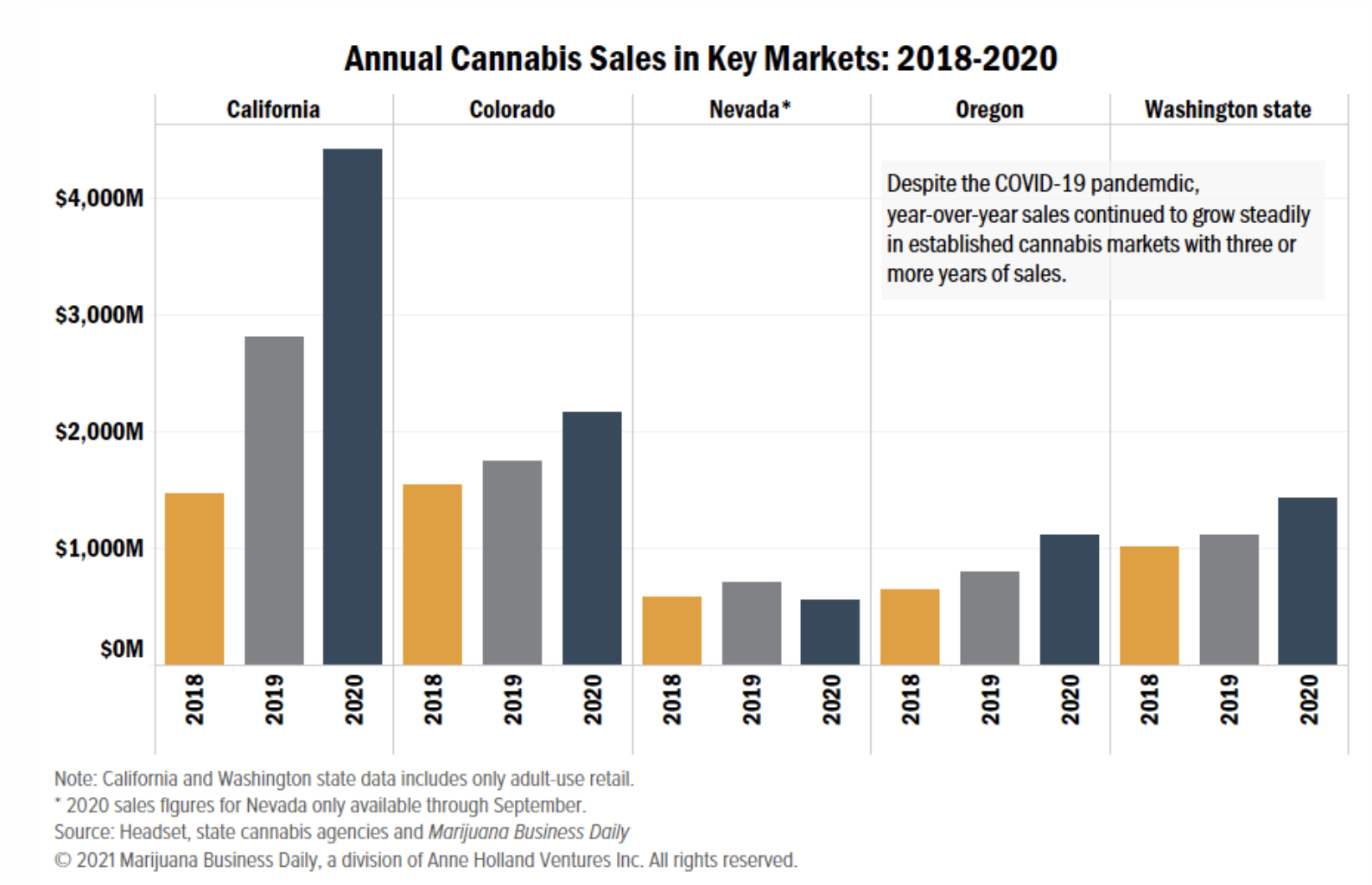

States smashed prior years’ sales records, despite COVID-19

2020 was an odd year, with the onset of a global pandemic, quickly-changing local regulations, and an eventual “essential” status for cannabis businesses.

Throughout all this, though, several states crushed prior year sales records, including mature markets like California, Oregon, and Colorado.

Marijuana Business Daily says experts expect this trend of increasing market size to continue.

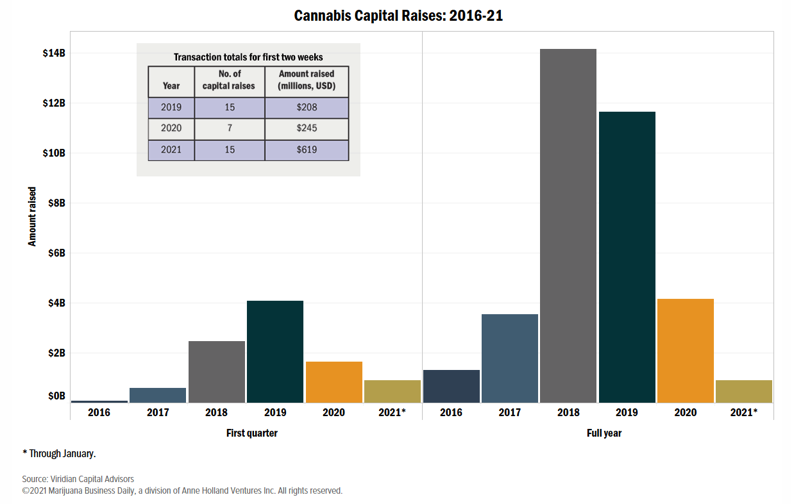

Cannabis capital raises declined in 2020

Investments into cannabis brands, including capital raises, slowed dramatically in 2020.

However, once dispensaries were deemed essential, investors showed renewed interest. $2.6 billion was raised in the first half of 2020 — a 67% decline.

However, following a Democratic election, North American cannabis companies raised over $1.6 billion in January 2021 alone.

5. Employment demand

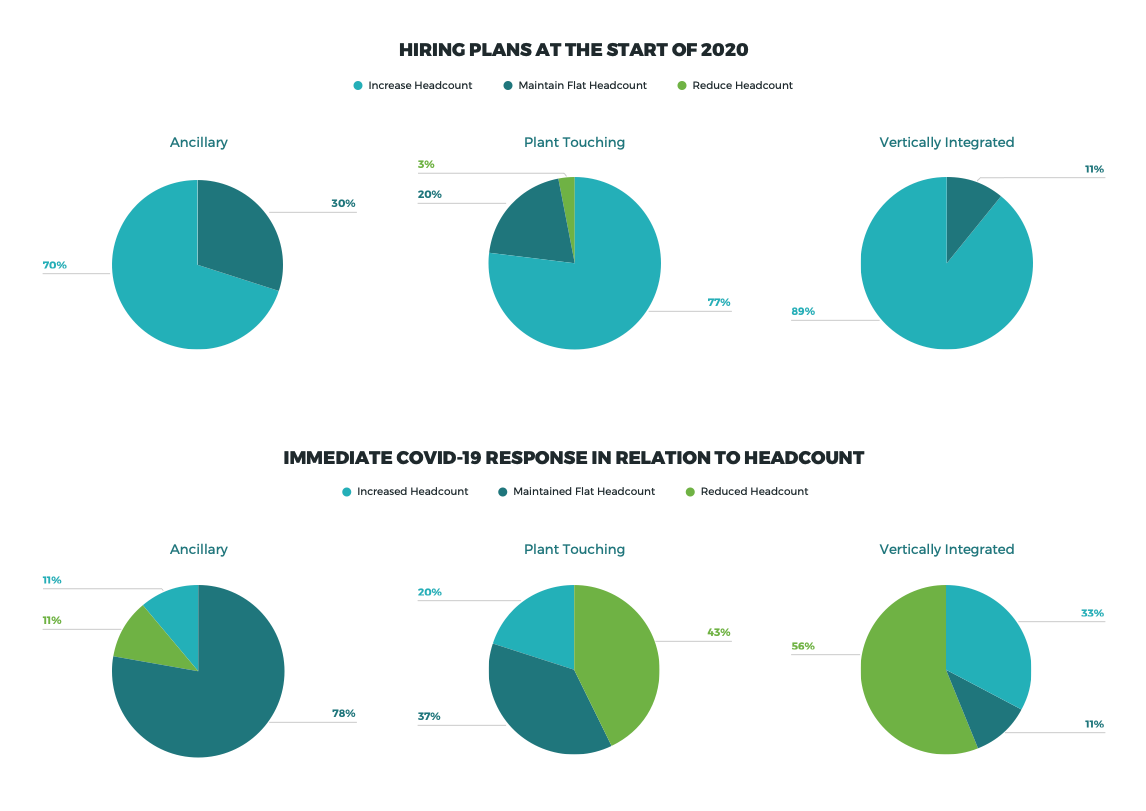

2020 staffing stalled during COVID-19; resumed pace by year-end

The 2020 Cannabis Industry Salary Guide from staffing agency, Vangst, found that most companies were planning to increase headcount in 2020.

However, the immediate reaction once the pandemic swept the U.S. was to maintain or even reduce headcount.

Hiring bounced back by Fall 2020. And while mature markets, like Denver, LA, Portland, and Seattle were hotspots for hiring cannabis-experienced professionals, the place to look for job seekers wanting to enter the industry are new legal marijuana markets are Detroit, Boston, Chicago, Tulsa, St. Louis, Reno, Tucson, Newark, and Philly.

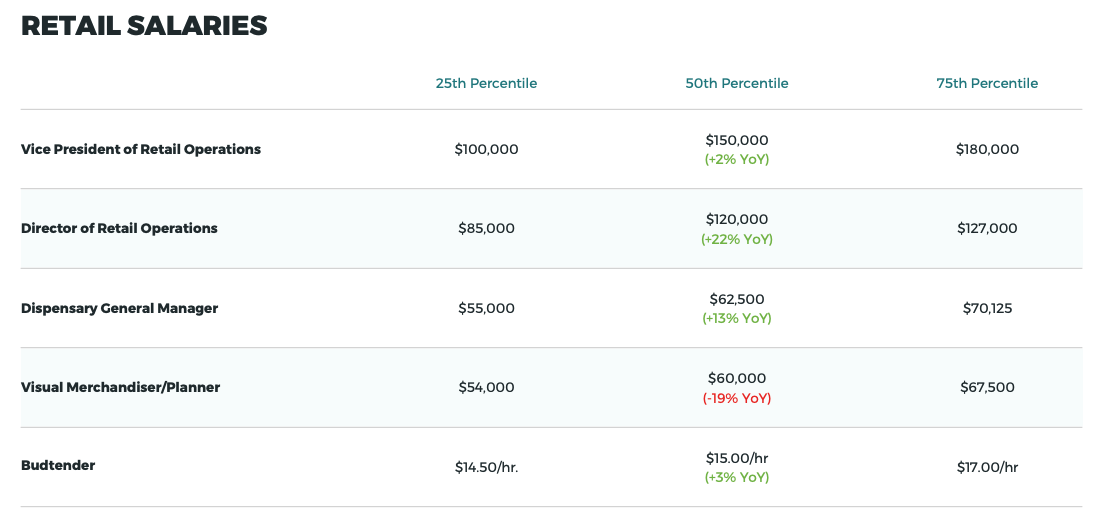

Senior-level cannabis salaries increased in 2020

According to Vangst’s survey of marijuana industry professionals, median salary for retail roles increased in 2020 (compared to 2019).

Dispensary General Manager salaries increased by 13% and Director of Retail Operations saw a healthy 22% increase.

See the report for details on salaries for retailers, cultivators, extractors, and more.

20,000 new cannabis jobs expected in 5 years

As new states enter the legal market, with it comes new cannabis workers.

Vangst found that in the new states alone — Montana, South Dakota, New Jersey, Arizona, and Mississippi — 26,000 new jobs are expected in the next five years. Nearly 20,000 jobs are anticipated in New Jersey alone.

Thousands of cannabis jobs are currently posted on Glassdoor nationwide.

6. Legal updates

Cannabis won the 2020 elections

Every cannabis-related ballot measure in 2020 passed, including a few new medical markets, and several new recreational markets.

South Dakota was the first state to legalize medical and recreational marijuana at the same time.

And with 1 in 3 Americans now living in legal states, the rest of the U.S. is facing pressure to legalize as well.

Immediately after the election, with Joe Biden winning and Democrats taking control of the House and Senate, legalization conversations intensified.

New York, followed by the rest of the Northeast, is making headlines with plans to move legalization forward, recognizing the economic impact and tax revenue of legalization and the desire to stay competitive with neighboring states.

Democratic Senators eye federal legalization

In early February 2021, top Democratic Senators made waves with talks of legalizing marijuana federally. The conversation went from “if” to “when.”

While any decision and corresponding nationwide changes would be slow, this proves to be the first time that conversations are likely to move past both the House and Senate.

New U.S. Cannabis Council advocates for federal legalization

Several top cannabis businesses, associations, and advocacy organizations joined to create the U.S. Cannabis Council (USCC).

The mission of the council is to “align and unify its members’ collective voices to advance cannabis reform” and also to “focus on securing federal reforms that advance social equity and promote fair, safe, and well-regulated markets nationwide as states continue legalizing cannabis at a rapid rate.”